View Procedure

| Procedure Name | Permanent Exports |

|---|

| Description |

|

Category

|

Clearance

|

|

Responsible Agency

|

Eswatini Revenue Authority.

Address: Portion 419 of Farm 50,

Along MR103

Ezulwini, Swaziland

Phone: (+268) 2406 4000/ 2406 4050

Fax: (+268) 2406 4001

Email: info@sra.org.sz

|

|

Legal base of the Procedure

|

Customs and Excise Act, 1971

|

|

Fee

|

No charge

|

Required Documents

|

No.

|

Type of information

|

Note |

|

1

|

Original invoice

|

Other supporting documents to be presented that may be required for verification purposes. |

| 2 |

Packing list of the goods

|

| 3 |

Transport document (e.g. bill of landing) |

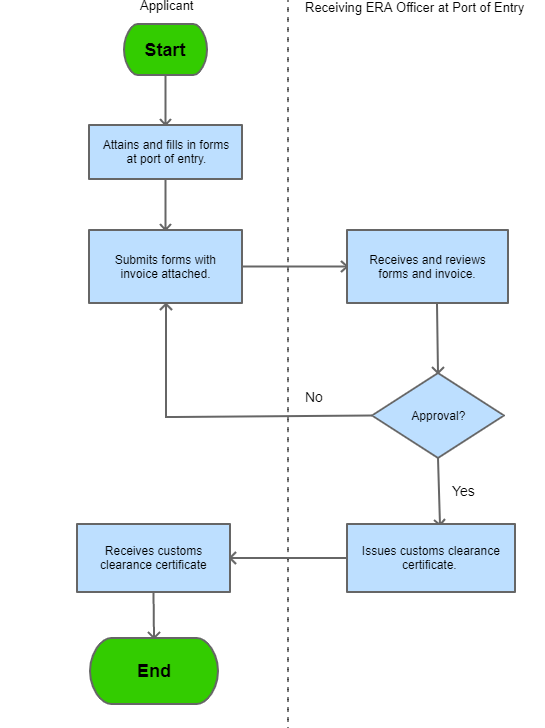

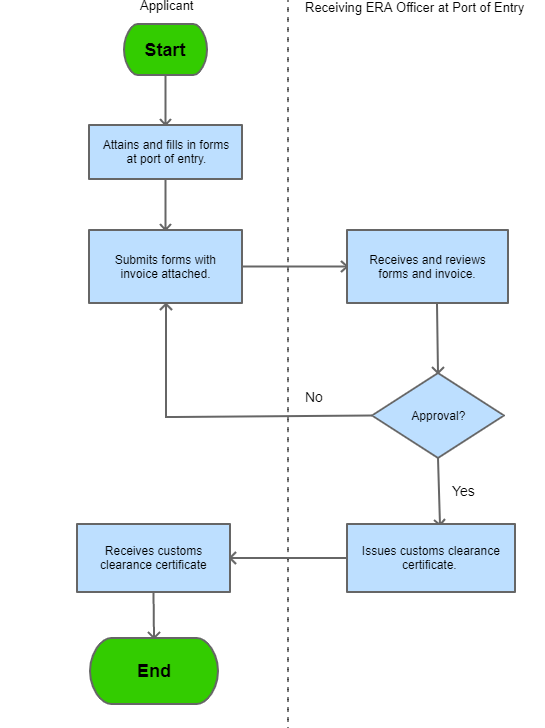

Process Steps

| Step 1 |

Attain Form at the port of entry. |

|

|

Step 2

|

Complete a declaration form which is used to declare goods exported, either by manufacturers or business owners.

|

|

|

Step 3

|

All supporting documents should be attached to the completed form.

|

|

| Step 4 |

The officer at port of entry processses the application and if approved, then issues a customs clearance certificate for the goods to pass through the border gate.

|

| Step 5 |

The exporter then recieves the clearance certifcate. |

|

|---|

| Category | Export |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| Permanent Exports | General | | Permanent exports refers to goods being exported to other countries for different purposes, e.g for sale, for gifting or for resale etc. | For an exporter to be eligible to export goods, they need to comply with the regulations set by the Eswatini Standards Authority. Clearance of goods have no charge. | The Customs and Excise Act, 1971 | 09-09-9999 | Good |

153