View Procedure

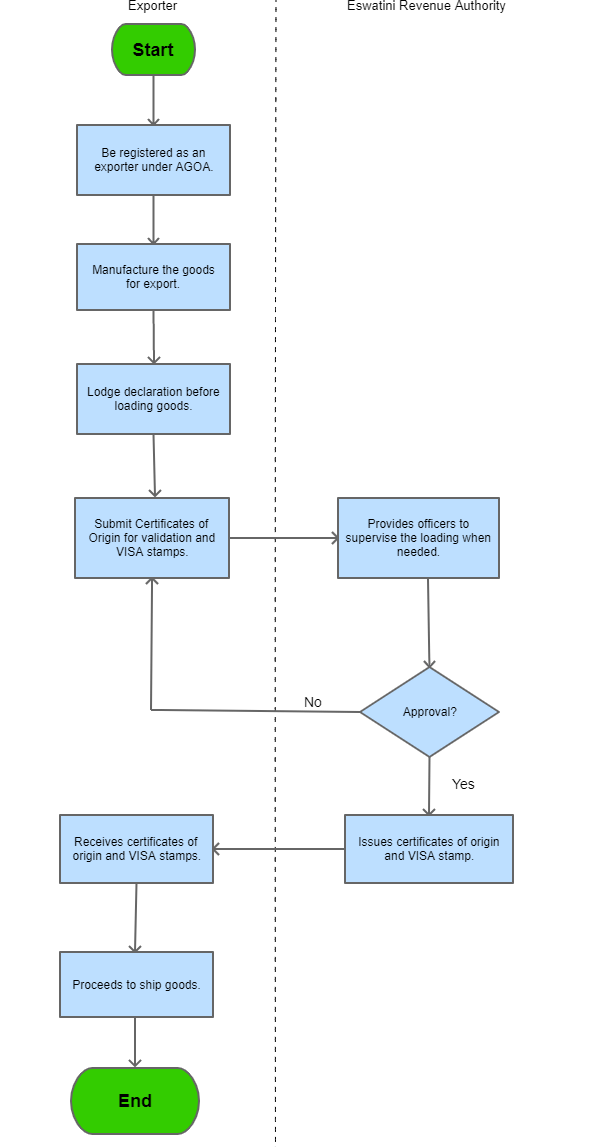

| Procedure Name | Exporting under AGOA | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Description |

Required Documents

Process Steps

| |||||||||||||||||||||||||||||||||||||||||

| Category | Export |

The following form/s are used in this procedure

| Title | Description | Created Date | Updated Date | Issued By |  |

|---|---|---|---|---|---|

| Application for Visa African Growth | The certificate may be printed and reproduced locally. If more space is needed to complete the Certificate, attach a continuation sheet. | 21-02-2020 | 21-02-2020 | ||

| Certificate of Origin | Rules for the preparation of the Certificate of Origin as published in 19CFR 10.214 pages 59679 and 59680 of the Federal Register volume 65, No. 194 of 5 October 2000 | 21-02-2020 | 21-02-2020 |

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

|---|---|---|---|---|---|---|---|

| Exporting Under AGOA | Duty/Tax Payable | AGOA refers to the African Growth Opportunity Act. Exporting under AGOA speaks to procedures to be followed as part of the administrative requirements set up to enable the registration of exporters and implementation of processes that will render the goods exported through these processes to benefit under AGOA and qualify for preferential treatment upon their importation into the US markets. | To be registered as an exporter under AGOA, an application should be submitted by completing forms CE185 (for manufacturers) and CE 49 02 (for exporters). Any exporter, manufacturer or trader of originating goods, permanently established in Eswatini or having headquarters in Eswatini, is entitled to apply to the ERA to become a registered Swazi exporter, provided that he holds, at any given time, appropriate evidence of the origin of the products he intends to export, for the purposes of checks carried out by the ERA. | The Customs and Excise Act, 1971 | 09-09-9999 | Good |